As a customer-centric organisation, our products are under constant development – we prioritise our development based on the needs of our customers. One of the main challenges our customers in rural Africa face is the difficulty in securing loans for their agricultural businesses. To tackle this, we have launched a new feature on our cooperative management tool, myCoop.online: Internal Loan Management.

With the loan management feature, our cooperative customers in Mozambique, Kenya and beyond will be able to gain access to simple loans that aid business growth and help farmers manage fluctuating incomes more effectively.

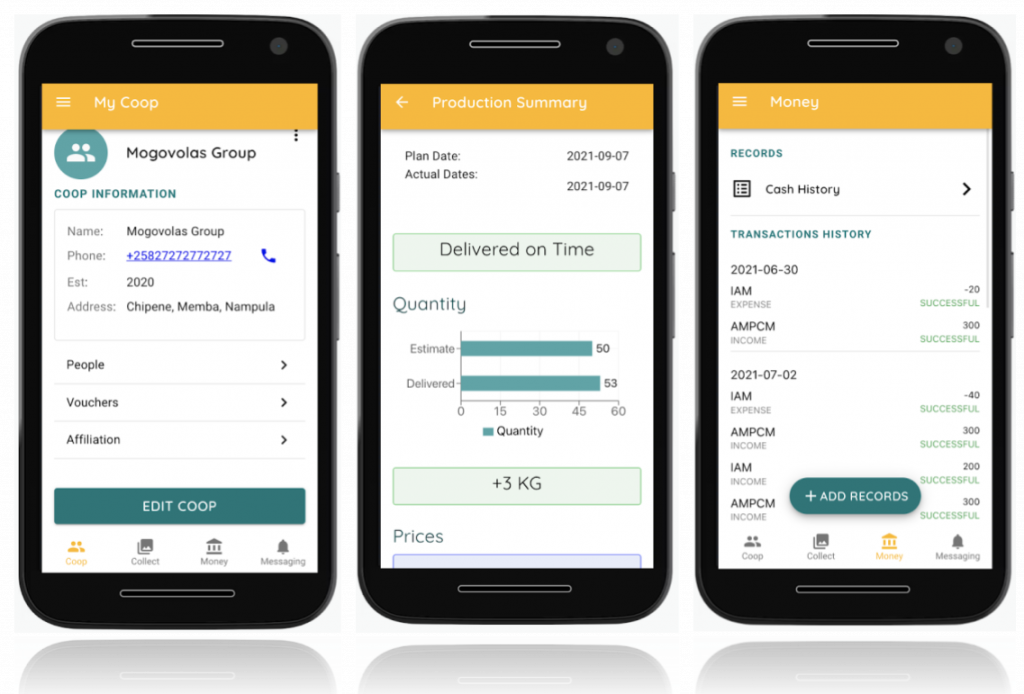

To achieve this we launched an ability for cooperatives to create internal loans for their groups on the app. This enables the cooperative manager to manage and oversee the internal loans within the group.

Here’s how it works:

- In myCoop.online, the coop manager inputs the loan amount, term, rates and who receives these loans.

- As repayments are made, the coop manager records these transactions on the application.

- The myCoop.online users that own a phone, receive sms receipts and confirmation of how much they have repaid, the amount outstanding and other information

- These records are recorded on the blockchain, and can be visualised in dashboards

- With the coops permission, these historical records and transactions can be shared with financial institutions, to show the reliability of their members

To ensure more inclusive lending, this new feature accommodates the current ‘rotating fund’ loan model that the coops use, where cooperatives or members in need can get assistance to invest in their businesses or help with cash flow.

Future Loan Integration on myCoop.online

In the coming year, significant progress is planned for the provision of third-party financial services to groups. Currently, the platform already includes a bank-grade loan book manager which provides core loan functionality, which will also be available for financial institutions.

Hiveonline’s integrated loan book management will provide bank-grade tools for group lending, managed over the simple myCoop.online app by the coops, and a web-based portfolio tool that will be available for financial institutions, so that MFIs and other lenders can manage lending to groups without the need for full integration. Loans are configurable so both groups and lenders can apply loan terms, interest rates, service charges as needed.

Keep an eye out for developments, by signing up for our newsletter here.

Blockchain and Mobile Money

We also plan to introduce insurance and asset finance in future developments. There is the potential for implementing electronic money using blockchain technology to allow for easy creation and management of these financial products, making them accessible to communities like Farmers’ Associations, Cooperatives and Savings groups, without the need for financial skills or sophisticated models. Hiveonline is operating multi-token fund models for communities that can be adapted to support the needs of these communities.

Reputation Score

Trust is an important component of well-functioning economies, especially when it comes to our cooperatives, which rely on commitments, repayments and agreements. Prior to our myCoop.online rollout, the lack of common record keeping and lack of digitisation made it hard for our partners to discern trustworthiness in actors which ultimately increases friction in doing business and receiving support.

Hiveonline’s reputation score builds an objective measure of trustworthiness based on financial and non-financial inputs, including the loan data gathered and the very popular production plan feature.

How your organisation can get involved

We are on a journey to create sustainable digital finance for the next billion and we understand that alone, we will not enable financial inclusion so that is why we need you.

If you are an MFI, Bank or commercial partner looking to work with agricultural cooperatives and associations, you can get involved by requesting a demo with us here.