vsla.online

a digital solution for savings groups

hiveonline unlocks access to affordable credit, insurance and savings for communities in the informal economy

Digital savings group accounting with blockchain technology

hiveonline gives unbanked communities access to financial services. Savings group structures such as VSLAs, SILCs, Tontines, ROSCAs and others have helped members, mostly women, build financial resilience. hiveonline’s community finance platform helps them grow their businesses.

It’s built on blockchain for security and resilience, but configured for people with limited access to technology. With a minimum of one device per group, every member can have an account with identity and a digital history.

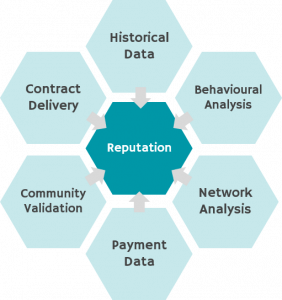

Fact-based reputation & access to credit

hiveonline community finance builds the bridge between informal communities and the financial system. We dramatically reduce the cost and risk of lending to informal businesses and savings groups.

Groups record their transactions on the blockchain during their meetings with vsla.online, growing an alternative credit score for microfinance institutions. Group default rates are low – typically less than 2% – so lenders can reach reliable customers while groups and members can access investment for their businesses.

Data management and evaluation

vsla.online was first developed for Niger, sponsored by CARE, the inventors of the VSLA model. Initially built for the world’s least developed country, the app is tolerant of low connectivity, designed for low data usage and low literacy, and seamlessly replicates savings group meeting procedures already familiar to group members.

Real time monitoring dashboards help NGOs assist groups in savings goals and show impact to their donors while the VSLAs simplify accounting procedures. Our vouchers are a low-cost solution to distribute government, donor or relief funds directly to groups, enhancing transparency and impact.

Read more about VSLA.online

Affordable micro-transactions with e-money

Because vsla.online is built on blockchain, it can be far more than an accounting app. It can facilitate micro-transactions via a native stablecoin, pegged to national currency, to provide cheap digital cash (with the requisite licensing).

vsla.online can also integrate with existing mobile money solutions, reducing the need to meet in person (licence not required).

sustainable microfinance & community saving

- credit history for 350 million unbanked SMEs

- demonstrate property rights without formal ID

- audibility and transparency

- removes opportunities for corruption

- sustainable financial ecosystems without the risk of cash