The Operating System for the Rural Economy

Scalable, low-cost digital infrastructure that turns community trust into verifiable financial history.

More Than Just an App

The hiveonline platform is the digital backbone for the informal sector. It is a comprehensive ecosystem designed to bridge the gap between remote communities and the formal financial system.

We don’t just record transactions; we digitize the complex web of relationships, trust, and trade that defines rural economies. By providing a secure, immutable ledger for these interactions, we create a digital footprint for farmers who were previously invisible to the global economy.

Built for Scale & Stability

Why Blockchain?

In markets where formal identification is rare and paper records are fragile, trust is the most valuable currency. We utilise distributed ledger technology (blockchain) to create an immutable source of truth.

Unlike a standard database, our ledger provides independently verifiable proof of every interaction—from a bag of crops delivered to a loan repaid. This transparency is critical for giving financial institutions the confidence to lend to previously “invisible” communities.

Powered by Hedera Hashgraph

To serve millions of users living on less than $2 a day, transaction costs cannot be volatile. That is why we migrated our entire operational platform to the Hedera Hashgraph network.

- Predictable Economics: Fees are fixed at a fraction of a penny ($0.0001), allowing us to offer cheap transactions over our platform.

- Energy Efficient: Our infrastructure is sustainable by design, consuming 0.0001 kWh per transaction—a fraction of legacy networks.

- Massive Scalability: Over 75,000 users migrated with a projection of 2 million+ transactions in the coming years.

Contextual Applications

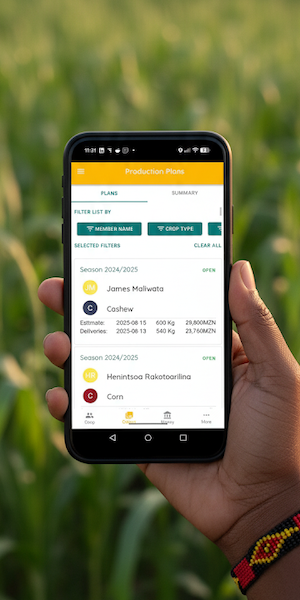

MyCoop (Farming Communities)

Manages production plans, tracks crop deliveries, and aggregates produce for better market access. It connects cooperatives directly to offtakers and input suppliers.

- Community Membership

- Production Plans

- Harvest Aggregation

- Input Marketplace

- Offtaking and selling Marketplace

- Integrated payments

- Learning modules

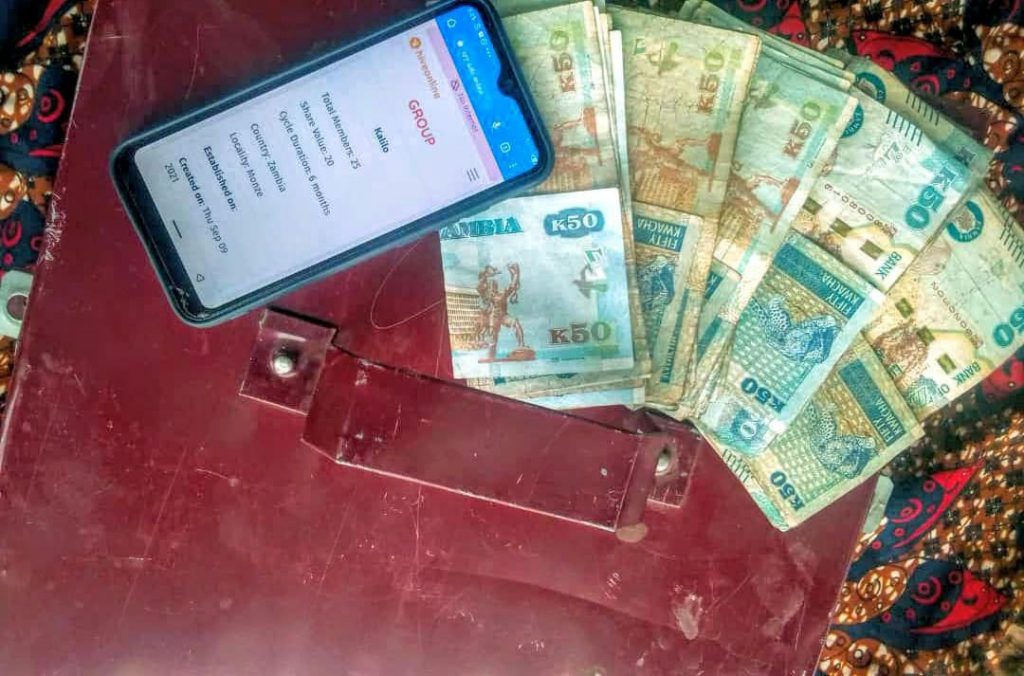

VSLA (Savings Groups)

Digitizes Village Savings and Loan Associations. It replaces paper ledgers with immutable digital records of savings, internal lending, and meeting attendance.

- Group membership

- Meeting tracking

- Savings and deposits

- Internal loans

- Welfare, membership and fines

- Cash out workflows

- Learning modules

From “Invisible” to “Bankable”

We don’t just provide a KYC; we provide a rich, verifiable Digital History.

For Financial Institutions

Access reliable KYC and financial history data to de-risk lending and lower the cost of customer acquisition.

For NGOs & Development

Get real-time Monitoring & Evaluation (M&E) data, ensuring funds reach the last mile with full transparency.

Ready to Integrate?

Our platform is modular and API-first, designed to plug into existing banking systems, mobile money networks, and supply chain logistics.