Empowering the African Informal Economy

.

.

.

Using digital technology to build opportunities

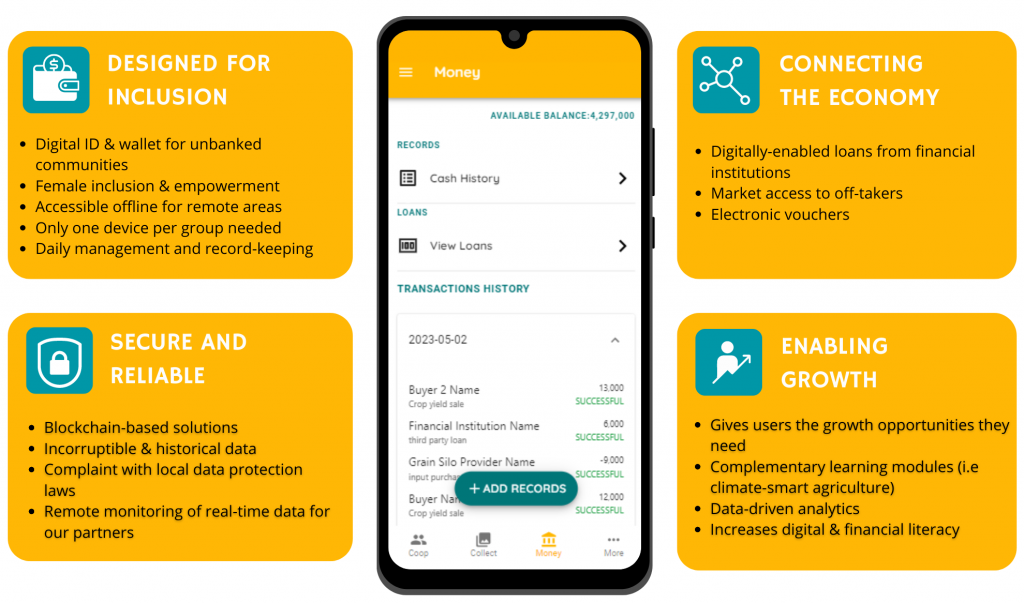

We strongly believe in the potential of innovative technology to promote development, enhance resilience and aid micro-entrepreneurs worldwide in achieving their goals and livelihoods.

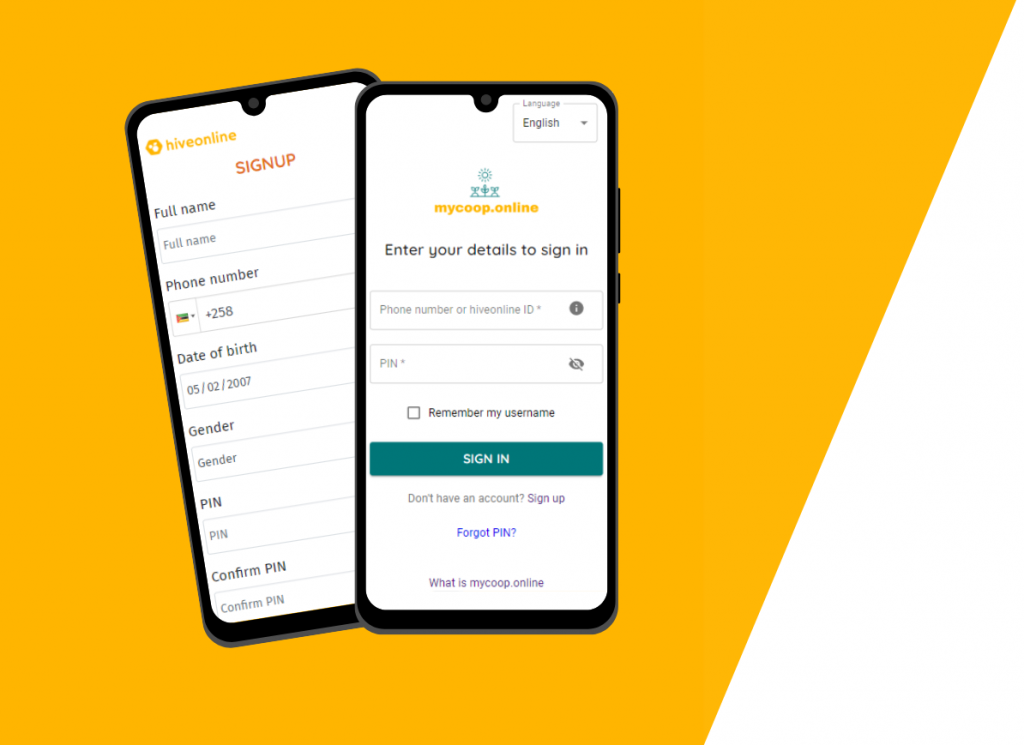

Our mobile-based digital solutions bring trusted data and relationships to rural communities in savings groups and cooperatives, facilitating their access to financial services, agricultural inputs, and market buyers.

Our work has already helped thousands of smallholders in five countries improve their farming and saving practices.

.

.

.h

The Challenge

Millions of communities across Africa are trying to build a better future but are faced with a lack of resources, growing inequality (including gender-based inequalities), climate change risks and weak linkages among actors within agricultural value chains. Only 1% of bank lending on the continent is allocated to the agricultural sector yet more than 60% of the population of sub-Saharan Africa is smallholder farmers.

As small-scale farms in developing countries play a crucial role in feeding local populations and meeting international demand for agricultural commodities, access to the right resources and linkages unlocks tremendous opportunities for these communities. hiveonline is the connective tissue that links key actors (lenders, off-takers, NGOS and rural communities) in the economy and provides them with opportunities to forge equitable trading relationships.

.k

Our Impact at a Glance

- 40,000+ smallholder farmers

- Working with marginalised communities in Mozambique, Kenya and Ghana

- Regulatory approval from the Central Bank of Mozambique to facilitate third-party lending and financial inclusion to communities

- Supporting the production and sale of 52 crops, with focus on strengthening the cashew and groundnut value-chains

- Enabling climate-resilient adaptation with communities in Kenya, partnering with local organisations

Select a location to learn more about our past and current projects.

Our Partners

Donors or Grantmakers

NGOs or Commercial Partners

Accelerators or Research Partners

Recent Updates

- Empowering 2,000 Women Farmers: Hiveonline, CYNK, Flux and KenGrow Collaborate

Hiveonline, CYNK, Flux and KenGrow are partnering to lead a year-long project to empower 2,000 women smallholder farmers in Kenya sustainably. This strategic collaboration is driven by clear objectives that promote financial… Read More »Empowering 2,000 Women Farmers: Hiveonline, CYNK, Flux and KenGrow Collaborate

Hiveonline, CYNK, Flux and KenGrow are partnering to lead a year-long project to empower 2,000 women smallholder farmers in Kenya sustainably. This strategic collaboration is driven by clear objectives that promote financial… Read More »Empowering 2,000 Women Farmers: Hiveonline, CYNK, Flux and KenGrow Collaborate - 🎉A Momentous Day for hiveonline – Regulatory approval in Mozambique!

After an intensive year, hiveonline has successfully completed the Mozambique Central Bank’s Regulatory Sandbox. This transformative initiative is driving accessibility to quality financial products and services for Mozambique’s smallholder farmers and agricultural… Read More »🎉A Momentous Day for hiveonline – Regulatory approval in Mozambique!

After an intensive year, hiveonline has successfully completed the Mozambique Central Bank’s Regulatory Sandbox. This transformative initiative is driving accessibility to quality financial products and services for Mozambique’s smallholder farmers and agricultural… Read More »🎉A Momentous Day for hiveonline – Regulatory approval in Mozambique! - Farming for Resilience: The Overlooked Potential of Smallholder Farmers in Combating Climate Change and Strengthening Food Security?

Smallholder farmers are essential actors in building climate change resilience. Adopting sustainable farming practices helps them adapt to climate challenges and contributes to global mitigation efforts by sequestering carbon and reducing emissions… Read More »Farming for Resilience: The Overlooked Potential of Smallholder Farmers in Combating Climate Change and Strengthening Food Security?

Smallholder farmers are essential actors in building climate change resilience. Adopting sustainable farming practices helps them adapt to climate challenges and contributes to global mitigation efforts by sequestering carbon and reducing emissions… Read More »Farming for Resilience: The Overlooked Potential of Smallholder Farmers in Combating Climate Change and Strengthening Food Security? - Let’s Talk about Securing CVA Distribution: The Case of Fraud in Cash Distribution in South Kivu, DRCToday, we take a look at the shortcomings of existing financial services for supporting humanitarian and development programmes! GiveDirectly, a trusted cash aid distributor, found itself embroiled in a colossal fraud, losing… Read More »Let’s Talk about Securing CVA Distribution: The Case of Fraud in Cash Distribution in South Kivu, DRC

- Hiveonline ApS announces strategic partnerships across the public and private Agricultural Finance ecosystem to bring growth opportunities to smallholder farming communities

hiveonline is pleased to announce significant partnership milestones in its mission to drive financial inclusion and foster the growth of the digital economy in Mozambique and Kenya. Agreements with trading partners, financial… Read More »Hiveonline ApS announces strategic partnerships across the public and private Agricultural Finance ecosystem to bring growth opportunities to smallholder farming communities

hiveonline is pleased to announce significant partnership milestones in its mission to drive financial inclusion and foster the growth of the digital economy in Mozambique and Kenya. Agreements with trading partners, financial… Read More »Hiveonline ApS announces strategic partnerships across the public and private Agricultural Finance ecosystem to bring growth opportunities to smallholder farming communities